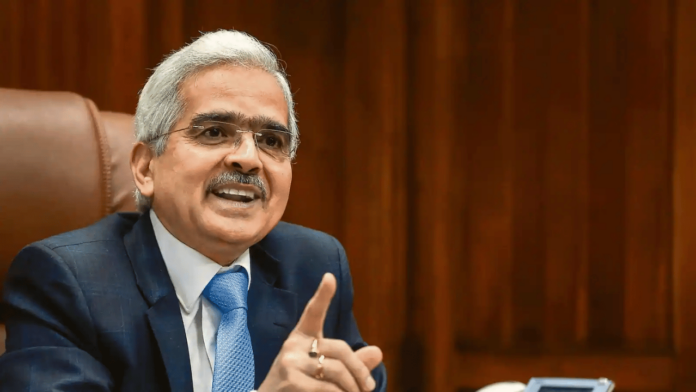

The minutes of the Monetary Policy Committee (MPC) meeting held this month were released by the Reserve Bank of India (RBI) on Thursday. The meeting took place between the 6th and 8th of February. During the meeting, RBI Governor Shaktikanta Das said that the RBI’s job of controlling inflation is not yet over. He cautioned that any hasty steps taken on the policy front could weaken the success achieved so far in tackling inflation.

According to the statement released after the Monetary Policy Committee (MPC) meeting in February, Das said that the MPC should remain vigilant at this juncture and should not assume that its job regarding inflation is finished.

RBI Governor Shaktikanta Das began the month’s deliberations by voting to maintain the main interest rate at its current level to keep inflation in check and financial stability. According to the minutes of the meeting, the Governor said, “As the central bank is moving forward with the expectation of cuts in policy rates, any steps taken prematurely could weaken the success achieved so far.”

“It is essential to maintain control over inflation and financial stability to sustain high growth rates over the long term,” he said. “At present, it is imperative from a policy perspective to focus on achieving the sustainable 4 percent inflation target.”

Five out of six members of the MPC voted in favor of keeping the short-term benchmark lending rate at 6.5 percent. External MPC member Jayant R Varma advocated for a 25-basis-point cut in the repo rate and shifting to a neutral stance. One MPC member voted in favor of a 25-basis-point cut in the repo rate.

However, MPC member Jayant Varma argued that without deviating from the inflation target, there may be room for cuts in interest rates. Varma said, “The time has come for the MPC to convey that it takes both inflation and growth seriously.” Varma voted in favor of a 25-basis-point cut in interest rates.

According to the statement released after the meeting, RBI Deputy Governor and MPC member Michael Devvrat Patra said that monetary policy should remain accommodative and pressure on inflation should be maintained. He said that only when inflation is low and stable should any cuts be considered.